Source: CSCT

The rise and fall of Star Cell therapy companies may point to some common problems in the development of cell therapy companies, not only the science itself, but also the trade-offs of multiple flowering pipelines and the advance and fall of partnerships with big companies.

BioCardia, a cell therapy company, reported interim results from a Phase 3 study of its CardiAMP cell therapy in heart failure on September 5. BioCardia said the study did not meet its primary endpoint. The study was suspended on July 24 at the recommendation of the U.S. Data and Safety Monitoring Board (DSMB), and the interim efficacy results confirmed the DSMB's prediction at the time. However, BioCardia claims that the interim efficacy review of DSMB does not represent the final results of the study, but is part of an adaptive statistical analysis program. The study was not a complete failure.

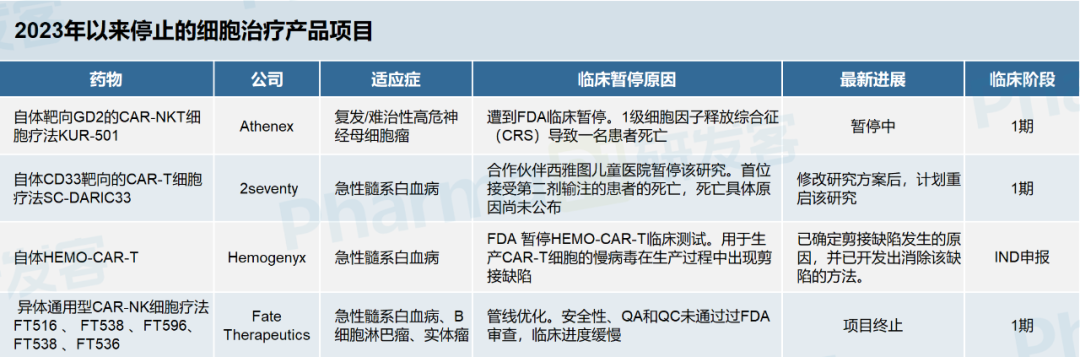

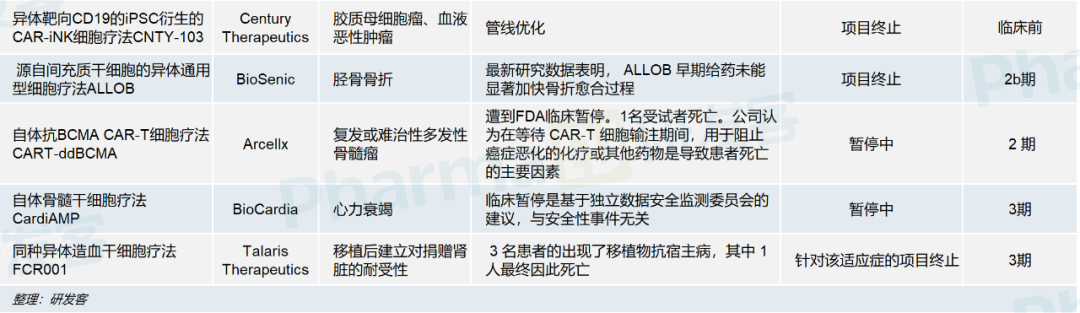

According to the press release, although the efficacy of CardiAMP was not statistically significant, there was a clear trend of patient benefit and no immediate safety concerns were raised. Although the results cleared some of the doubts about the project's failure, BioCardia shares fell 30% after the news. In fact, clinical pauses or project failures are common in the field of cell therapy. According to incomplete statistics of developers, as of 2023, 13 clinical studies of cell therapy products have been halted by regulatory authorities or companies have actively terminated research and development. Five of these products use autologous cells, including three CAR-T, one CAR-NKT and one bone marrow stem cell therapy. The other eight products are allogeneic cell therapies, mainly derived from induced pluripotent stem cells (IPscs) and mesenchymal stem cells. (See picture below)

The indications involved mainly include acute myeloid leukemia, neuroblastoma, multiple myeloma, heart failure, fracture and tolerance establishment after kidney transplantation. The companies involved include star cell therapy companies like 2seventy, Fate Therapeutics and BioCardia.

One of the most regrettable is Fate Therapeutics, a leading star company in the iPSC field. Between 2020 and 2021, Fate Therapeutics had a good time, with a market capitalization of more than $12 billion. Later, after the breakup with Johnson & Johnson at the beginning of this year, it experienced major layoffs and pipeline cuts, including the abandonment of five IPSC-derived CAR NK cell therapies, which fell to $400 million at the time, and now only $256 million.

There are serious safety problems in early clinical stage

The most common cause of clinical suspension is safety. Nine cell therapy products have been suspended due to safety concerns, including three early stage studies and one phase 3 study that resulted in patient deaths. It is worth noting that these three early studies are all autologous CAR-T therapy, which sounds the alarm for the development of autologous CAR-T that seems mature at present.

In March of this year, Athenex disclosed in its earnings release that Phase 1 clinical trials of its GD2-targeting autologous CAR-NKT cell therapy, KUR-501, in relapsed/refractory high-risk neuroblastoma (R/R HRNB) had been halted by the FDA. The reason was that in the trial, a young male patient with human metapneumovirus infection developed grade 1 cytokine release syndrome (CRS) and polyclonal leukocytosis after receiving the fifth dose of infusion, and died about 3 weeks later.

In June, a patient with acute myeloid leukemia (AML) died in a Phase 1 clinical trial of 2seventy's CD33-targeted CAR T-cell therapy SC-DARIC33, and 2seventy's partner, Seattle Children's Hospital, suspended the study while the cause of death is under investigation.

During the same period, the FDA suspended the Phase 2 trial of CART-ddBCMA, a cell therapy developed by Arcellx for relapsed or refractory multiple myeloma (rrMM). Arcellx revealed in a press release that bridging therapy with chemotherapy or other drugs used to stop cancer progression while waiting for CAR T cell transfusions was a major factor in one patient's death. Arcellx is in communication with the FDA to expand patient options.

The deaths didn't just happen in the early studies.

Talaris Therapeutics' core product candidate, FCR001, developed graft-versus-host disease in three patients in a Phase 3 study of post-transplant tolerability of donated kidneys, one of whom eventually died. In a statement released in February, Talaris Therapeutics said it discontinued two Phase 3 trials of FCR001 for kidney transplantation, retaining only one Phase 2 study evaluating the ability of FCR001 cell therapy to induce tolerance in scleroderma.

For Fate Therapeutics, the termination of cooperation with Johnson & Johnson at the beginning of the year directly catalysed a series of pipeline reduction measures, including five phase 1 IPSC-derived CAR NK cell therapy products for acute myeloid leukemia, B-cell lymphoma, and solid tumors. The reason is that although the previously released phase 1 data is good, due to the safety of iPSC products and the QA and QC have been unable to meet the requirements of the FDA, resulting in the product stagnation for several years has been unable to move forward. At the same time, similar therapies derived from cord blood/peripheral blood from other companies have entered phase 2 clinical trials, resulting in Fate Therapeutics losing a certain first-mover advantage.

Century Therapeutics, also committed to the development of IPSC-derived immunoeffects-T cell therapies, announced earlier this year that it had discontinued CNTY-103 for glioblastoma and hematologic malignancies due to pipeline optimization considerations.

The setbacks of these iPSC stars highlight the potential safety challenges that IPscs face in clinical applications. For example, the tumorigenic risk of iPSC, in March 2022, researchers from Yunnan Cancer Hospital reported in the journal Stem cells and development a case of immature teratoma after receiving IPSC-derived cell treatment in other medical structures, and the teratoma was more aggressive than general teratoma.

At the same time, the unstable genome inherent in iPSC and the large differences between mature cells and truly mature cells differentiated by iPSC also lead to slow progress and difficulties in process development and expansion of production capacity of such products.

Regulators have been particularly concerned about the safety of such cutting-edge therapies as cell therapy. Hemogenyx's HEMO-CAR-T for acute myeloid leukemia was stopped by the FDA during the clinical application phase because of a splicing defect in the lentivirus used to make the CAR-T cells. According to FIERCE, the company has identified the reason why the splicing defect occurred and has developed a way to fix the problem.

In addition to safety concerns, there have also been cases where BioCardia's products have suffered effectiveness setbacks, as mentioned at the beginning of this article. In the latest phase 2b clinical study, BioSenic's ALLOB, a general-purpose cell therapy derived from mesenchymal stem cells, failed to significantly accelerate the healing process of tibial fractures in patients with early administration, and BioCardia terminated the study.

One more episode about ALLOB: Due to its remarkable efficacy in the phase 2a study, Chinese mainland banned projects involving foreign human cells and related clinical trials due to regulatory reasons, and cooperated to introduce its Asia-Pacific rights and interests, which was chosen by Chinese companies such as Prekin Biology and Lingsheng Medical, to introduce its Asia-Pacific rights and interests.

After the clinical failure of the product, it is also a pity for the two Chinese companies to stop the loss in time, but for the orthopedic field, which is already difficult to develop new drugs, the death of this important product is regrettable.

The star company has lost its luster

Many of the suspended or terminated programs were core products for these cell therapy companies and shook the company up no small amount.

The study that paused 2seventy was the first human study of its DARIC T cell platform, and the grade 5 (fatal) SAE occurred in the first patient to receive a second infusion, raising questions about cell therapies produced under the platform. With this study, 2seventy had hoped to lay the foundation for future CAR-T studies of CD33 targets and solid tumor targets, and the findings of this death will influence 2seventy's future product layout.

Talaris Therapeutics was founded in 2002 with the goal of developing a new type of cell therapy that would allow patients in need of an organ transplant to obtain an organ from any donor without having to take lifelong immunosuppressive drugs. Its FCR001 cell therapy, which includes hematopoietic stem cells, promoter cells, and aßTCR+T cells, has been demonstrated in previous clinical studies to enable living kidney transplant recipients to completely free themselves from immunosuppression one year after transplantation. However, the failure of FCR001 cell therapy Phase 3 has caused Talaris Therapeutics to lose its initial halo, and the company is also facing restructuring.

BioSenic is in a similar situation to Talaris Therapeutics. BioSenic, which was formed from the merger of Bone Therapeutics and French company Medsenic, has struggled with multiple late-stage clinical failures and layoffs. ALLOB was Bone Therapeutics' most important core product, and the termination of ALLOB represents a complete failure for BioSenic in the orthopedic field. The company has now shifted its research and development center to the development of oral arsenic trioxide (OATO) for chronic graft-versus-host disease (cGVHD).

In addition to Fate Therapeutics, Century Therapeutics is one of the most coveted companies in the iPSC space. Century Therapeutics went public on Nasdaq in 2021, just three years after its founding, and has yet to get a single product into the clinic, down nearly 90% from its initial public offering.

In fact, Fate Therapeutics, which has been deeply ploughed in the iPSC field for more than 10 years, is not the first time to encounter a crisis, the last time was in 2015, Fate Therapeutics terminated the adult stem cell therapy ProHema after 8 years of research and development, and the stock price plunged and was on the verge of collapse. Eventually, the IPSC-derived cell platform continued to produce a series of product candidates to survive.

After Fate Therapeutics broke up with Johnson & Johnson at the beginning of the year, some analysts speculated that this may be an active choice made by Fate Therapeutics after its delivery to Johnson & Johnson faced technical bottlenecks and was unwilling to transfer the intellectual property of its platform. If this is the case, it can be shown that Fate Therapeutics is still confident in the remaining products after the pipeline is slimmed down.

In the future, if Fate Therapeutics can make products for major diseases, it can also make a comeback, just as Moderna rose during the COVID-19 pandemic with mRNA vaccines.