Benefiting from the continuous listing of new CGT drugs and the increasing demand for treatment, the global CGT market has a good development prospect. The sales of CAR-T therapy Kymriah, Yescarta and gene therapy Zolgensma have increased significantly since they were put on the market. With the financial reports of major companies in the first quarter of 2024, the editor summarizes some of the revenue of CGT therapy for reference.

Cell therapy

Tecartus: $100m.

Yescarta: $380 million

Sales of Gilead's two CAR-T therapies targeting CD19, Yescarta and Tecartus, both grew in 2024 Q1.

Tecartus is an autologous CAR-T cell therapy targeting CD19, the third approved CAR-T therapy in the world, the first CAR-T cell therapy approved to treat adult patients with relapsed / refractory B cell precursor acute lymphoblastic leukemia (ALL), and the world's first mantle cell lymphoma (MCL) CAR-T cell therapy. 2024 Q1 Tecartus had revenue of $100m, up 12.4 per cent from a year earlier. Yescarta is the world's first chimeric antigen receptor T cell (CAR-T) therapy product for adult patients with recurrent or refractory large B-cell lymphoma (R LBCL) who have received second-line or more systemic therapy.

2024 Q1 Yescarta had revenue of $380 million, up 5.8 per cent from a year earlier.

Kymriah: $120 million

Kymriah is a CD19-directed autologous T cell immune cell therapy developed by Novartis. Kymriah is the first FDA-approved CAR-T therapy targeting CD19 antigen and has been approved by FDA and the European Union for the treatment of relapsed / refractory acute lymphoblastic leukemia and diffuse large B-cell lymphoma.

Kymriah's sales in 2024 Q1 were $120 million, down 11% from a year earlier.

Carvykti: $157 million

Legendary / Johnson co-developed Carvykti is a genetically modified autologous T cell immunotherapy for BCMA.

In February 2022, Carvykti was approved by FDA in the United States for the treatment of patients with recurrent / refractory multiple myeloma. On April 23, 2024, Legend announced that the European Commission (EC) had approved Carvykti for the treatment of adult patients with recurrent and refractory multiple myeloma who had previously received at least first-line treatment (including a proteasome inhibitor and an immunomodulator), developed the disease at the last treatment and were resistant to lenalidomide. In China, legendary Biology's application for the marketing of a new drug for Cedar Orenser injection has been included in the priority review by NMPA, and the proposed indications are: for the treatment of adult patients with recurrent or refractory multiple myeloma (R MM) after previous treatment with a proteasome inhibitor and an immunomodulator.

Total sales of Carvykti 2024 Q1 were $157 million (about 1.1 billion yuan), up 118% from the same period last year, and are expected to exceed $1 billion in 2024 (currently listed only in the United States, the European Union and Japan).

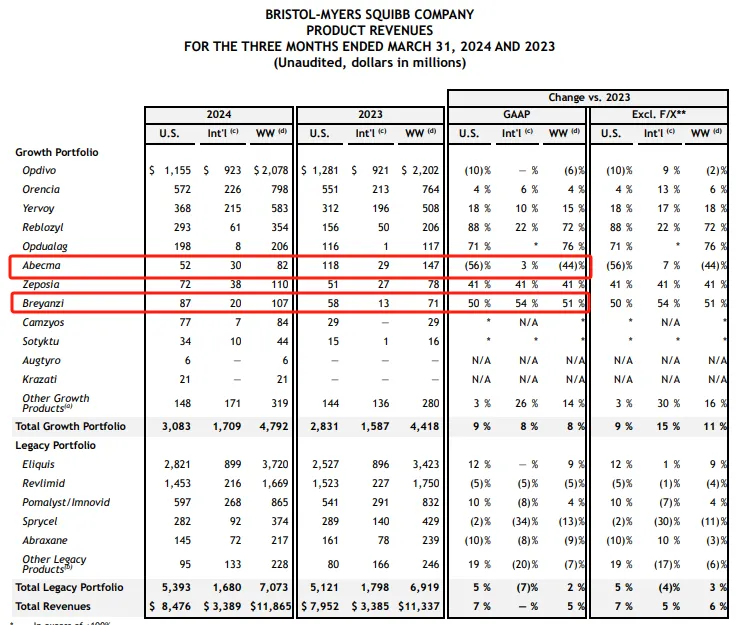

Abecma: $82 million.

Breyanzi: $107 million

Developed by Bristol-Myers Squibb (BMS) and Bluebird, Abecma is one of three approved CAR-T treatments for recurrent / refractory multiple myeloma, the world's first CAR-T cell therapy targeting BCMA and the fifth CAR-T therapy approved by FDA. 2024 Q1 Abecma had revenue of $82 million, up 44 per cent from a year earlier. Breyanzi is not only the first CAR-T therapy approved by BMS, but also the fourth approved CAR-T therapy in the world for the treatment of recurrent / refractory large B-cell lymphoma (LBCL). The approval of Breyanzi marks a milestone in cellular immunotherapy for Bristol-Myers Squibb, which BMS acquired when it acquired Celgene for $74 billion in 2019.

2024 Q1 Breyanzi had revenue of $107 million, up 51 per cent from a year earlier.

Gene therapy

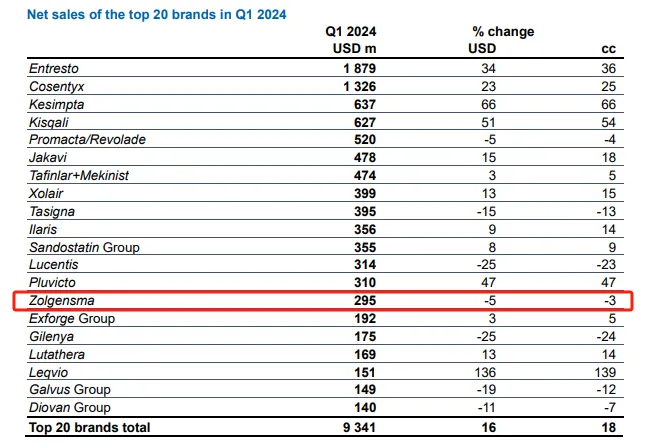

Zolgensma: $295 million.

Zolgensma is an AAV-based gene therapy developed by Novartis and the only approved one-time treatment for spinal muscular atrophy (SMA) in the world for children under 2 years of age with SMA. Zolgensma, acquired by Novartis's heavily acquired AveXis, was approved by FDA in 2019 and priced at $2.125 million. So far, the drug has been approved in 51 countries and more than 3700 patients have been treated.

Zolgensma sales in the seven months of 2019 reached $361 million; revenue in 2020 was $920 million, up 150 per cent from a year earlier; Zolgensma revenue was $1.351 billion in 2021, up 47 per cent from a year earlier; and revenue in 2022 was $1.37 billion, up slightly by 1 per cent. In 2023, Zolgensma sales were $1.214 billion, down 11% from a year earlier.

Sales of 2024 Q1 Zolgensma were $295 million, down 5 per cent from a year earlier.

The final data from the Phase IIIb SMART study show that Zolgensma is suitable for older, heavier SMA patients (1.5-9.1 years old, weighing ≥ 8.5kg to ≤ 21kg) than previous clinical studies. After 52 weeks, the motor development milestones of almost all patients who received treatment were maintained or improved, and most patients switched from long-term use of disease regulators to one-time gene therapy.

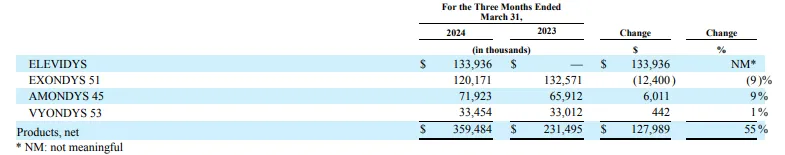

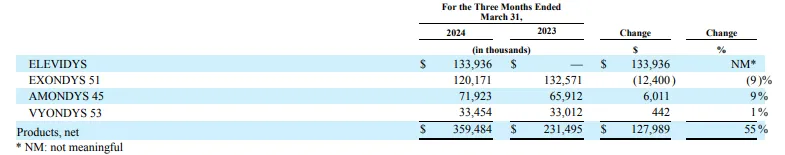

Elevidys:1.34 dollars.

Elevidys is a gene therapy based on adeno-associated virus (AAV) vector developed by small nucleic acid leader Sarepta Therapeutics for the treatment of Duchenne muscular dystrophy (DMD). Elevidys delivers the target gene encoding microdystrophin to bone and myocardial muscle tissue by genetic engineering to make up for the loss of dystrophin.

Sarepta's 2023 report showed that Elevidys had sales of $200.4 million in 2023, far exceeding expectations, while Elevidys had sales of about $134 million in 2024 Q1.

Small nucleic acid drugs

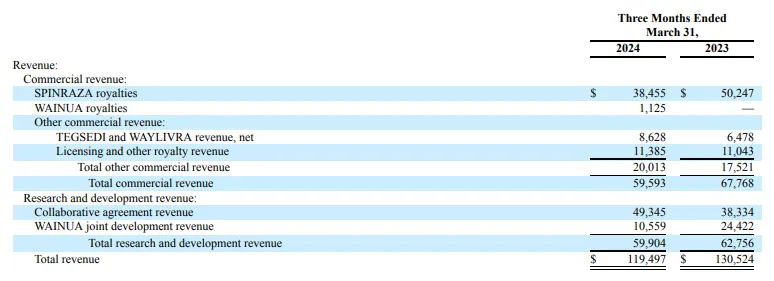

Eplontersen: $5 million.

Tegsedi+Waylivra: $9 million

Antisense oligodeoxynucleotides (ASO) therapy eplontersen (Wainua) is the first approved drug that can be self-administered through an automatic syringe to treat ATTRv-PN. The treatment, developed jointly by AstraZeneca and Ionis Pharmaceuticals, can be injected subcutaneously by patients themselves and used once a month. In December 2023, FDA approved Eplontersen for the treatment of adult polyneuropathy with hereditary transthyroxine protein (TTR)-mediated amyloidosis (ATTRv-PN).

Waylivra is an ASO drug jointly developed by Inois and its subsidiary Akcea Therapeutics. It was approved and put on the market in May 2019. The indications are chylomere syndrome and hypertriglyceridemia. Waylivra blocks the production of apolipoprotein C-III, which slows the decomposition of fat and reduces the level of triglycerides in the blood, thereby reducing the accumulation of fat in the body, which is expected to reduce the risk of pancreatitis.

Tegsedi is also an ASO drug for the treatment of stage 1 or 2 polyneuropathy in adult patients with hereditary transthyroxine amyloidosis (hATTR). Tegsedi can inhibit the production of TTR protein (including mutant and wild type).

2024 Q1 eplontersen sales of $5 million, Tegsedi and Waylivra combined sales of $9 million, an increase of 32.3% over the same period last year.

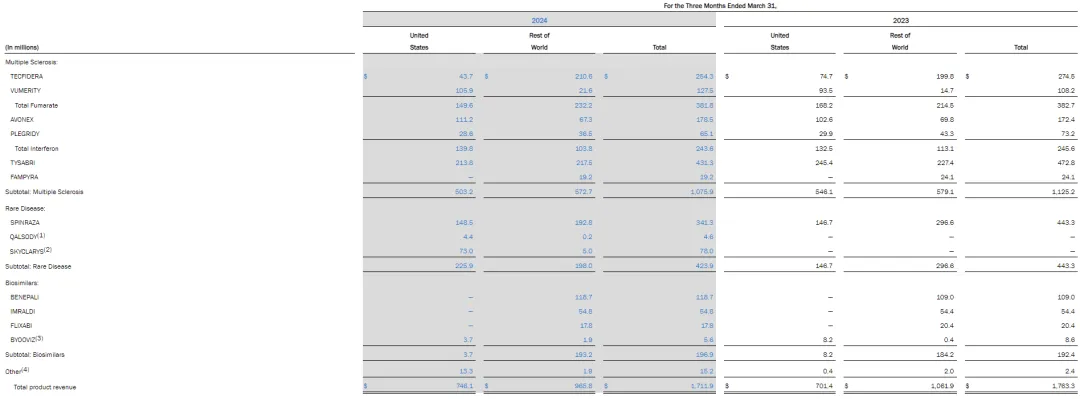

Spinraza: $341 million.

Qalsody: $5 million

Spinraza (nusinersen), an antisense oligonucleotide drug developed by Ionis Pharmaceuticals, is the first drug used to treat spinal muscular dystrophy (SMA) in children and adults. It takes less than six months for Nusinersen to submit its application to go public, with a cost of about $125000 per dose and an annual treatment cost of about $750000. But the high price did not stop Nusinersen from becoming popular, and Nusinersen launched in China in February 2019. At present, Nusinersen has been listed in more than 50 countries and regions.

Lonis 2024 Q1 reported that Spinraza's global sales were $341 million, down 23% from a year earlier.

As an antisense oligonucleotide drug, Qalsody can bind to mRNA encoding SOD1, causing it to be degraded by ribonuclease RNase-H, thus reducing the production of mutant SOD1 protein. On April 26, 2023, FDA announced the accelerated approval of antisense oligodeoxynucleotides (ASO) therapy Qalsody (tofersen) for the treatment of amyotrophic lateral sclerosis (SOD1-ALS) with superoxide dismutase 1 mutation. This is the first treatment approved by FDA for hereditary ALS. This is also the first ALS therapy based on biomarker accelerated approval.

2024 Q1 Qalsody has global sales of US $5 million.

Eteplirsen: $120 million.

Golodirsen: $33 million.

Casimersen: $72 million

ASO drugs Exondys 51 (eteplirsen), Vyondys 53 (golodirsen) and Amondys 45 (casimersen) developed by Sarepta were accelerated by FDA in 2016, 2019 and 2021 for Duchenne muscular dystrophy with exon 51, 53 and 45 jumping, respectively.

EXONDYS 51 (eteplirsen) is the first product approved by Sarepta for the treatment of DMD by FDA, and it is also the first DMD treatment product approved by FDA.

2024 Q1JI eteplirsen sales of US $120 million, down 9% year-on-year sales of VYONDYS 53 (golodirsen) 2024 Q1 US $33 million, 1% year-on-year increase of 1% TX Amondys 45 (casimersen) sales of US $72 million, an increase of 9% year-on-year.

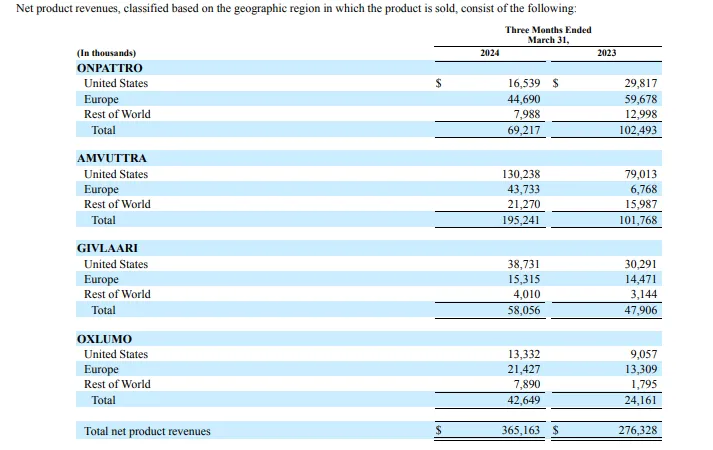

Onpattro: $69 million.

Amvuttra: $195 million.

Givlaari: $58 million.

Oxlumo: $43 million

Onpattro, Amvuttra, Givlaari and Oxlumo, the four siRNA products developed by Alnylam, have combined revenue of $1.242 billion. Onpattro (patisiran) is the first FDA-approved RNAi therapy (approved in August 2018) for adult patients with peripheral neuropathy (polyneuropathy) caused by hereditary transthyroxine amyloidosis. Onpattro had revenue of $69 million in 2024 Q1, down 32 per cent from a year earlier.

Amvuttra (vutrisiran) 2024 Q1 had revenue of $195 million, up 92 per cent from a year earlier. The drug was approved by FDA in June 2022 for the treatment of adult hereditary transthyroxine amyloidosis with polyneuropathy (hATTR-PN), which is the fifth approved siRNA therapy in the world and the first RNAi therapy approved by FDA to reverse neuropathy injury by subcutaneous injection every 3 months, and was approved by the European Union in September of the same year.

2024 Q1 GIVLAARI (givosiran) sales of US $58 million, an increase of 21% over the same period last year; mainly used for the treatment of acute hepatic porphyria (AHP); OXLUMO (lumasiran) sales of US $43 million, an increase of 77% over the same period last year; mainly used for the treatment of type 1 primary hyperoxaluria (PH1).

Summary

According to GlobalData's estimates, cell and gene therapy (CGT) will be the industry trend that will have the greatest impact on the pharmaceutical industry in 2024, and the global CGT market is expected to reach US $80 billion by 2029. Taking a comprehensive view of the decline in sales of many star therapies in the first quarter of 2024, the sales growth rate of Kymriah and Yescarta, as "veteran" products of CAR-T, showed a downward and slowing trend, which may be due to the oversupply of the current CGT track and the oversupply of products, but on the other hand, it also shows that patients have more and more drugs to choose from.